As the new year begins, the encryption market is bracing for the unknown. What are the main challenges and goals?

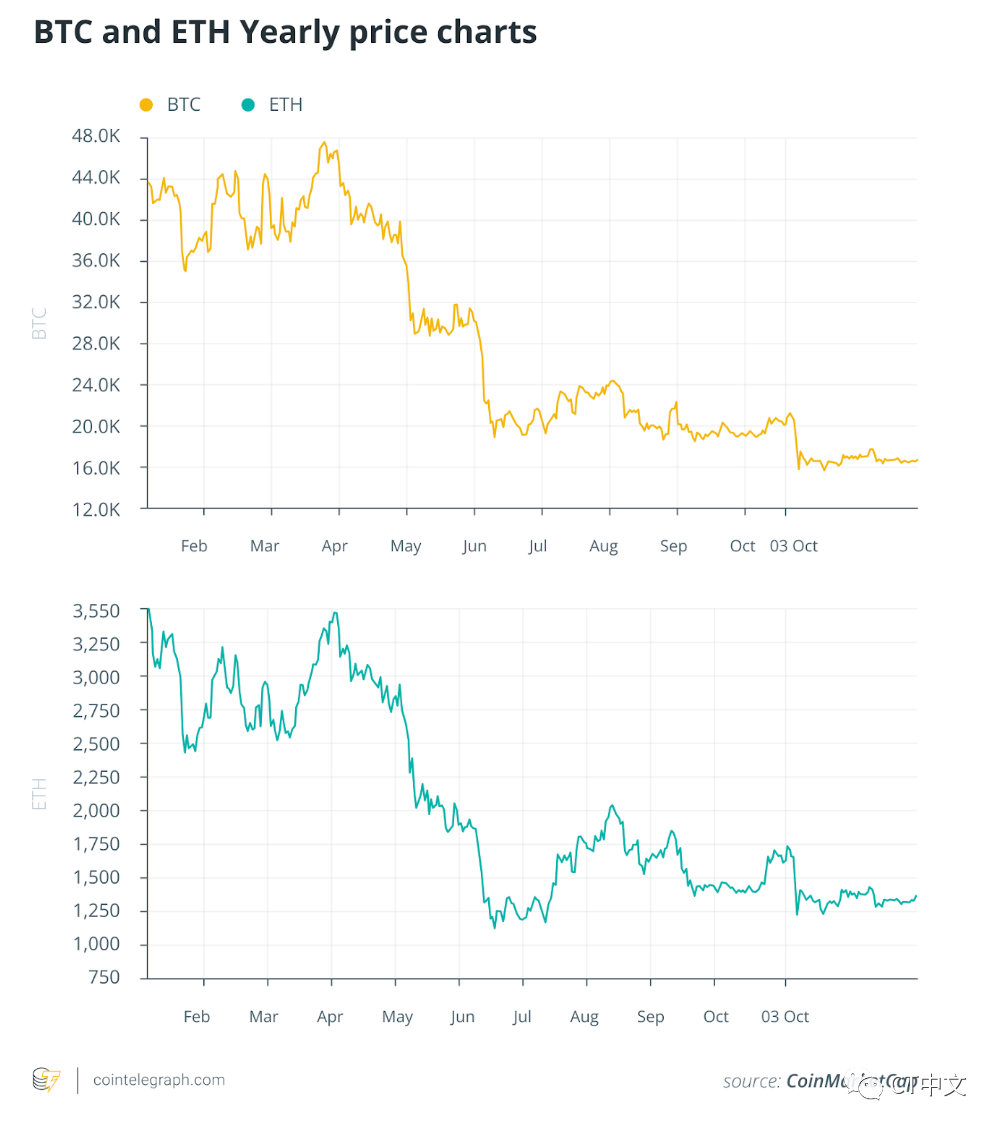

If 2022 is the template for gauging what the future of the crypto market might offer investors, it has proven to be very difficult to predict. The global cryptocurrency market capitalization has taken a brutal hit, dropping just over 60% from $2.2 trillion to about $797 billion so far. During the same time frame, BTC and ETH, the two largest cryptocurrencies by market capitalization, are down 64% and 67%, respectively, while the altcoin market is also in decline.

These price drops, combined with the demise of the FTX exchange, were not events that most, if any, could have foreseen. Furthermore, given that some crypto projects and venture funds have maintained financial accounts on the exchange, the impact of the FTX crash has yet to be seen.

That said, if 2022 is indeed chaotic, 2023 has to offer something more positive, but growth in the first quarter (if not the first half) of the year is likely to be sluggish.

Will 2023 follow the same pattern?

After the brutal events of 2022, there will inevitably be a period of adjustment, settling, and refocusing, all of which will drive months of reflection and intense repositioning before changes manifest in the markets.

Major changes in the macroeconomic environment are also unlikely in the short term. The so-called “crypto winter” will last at least for a while. But change will come. Whether this will be investor-led or corporate-led, though, remains to be seen.

What seems clear, though, is that as the market matures — and confidence picks up again — the market should shift in a positive direction; so it wouldn’t be enough if risk-taking investors acted earlier in the year rather than later. Surprisingly, this seems counterintuitive. Also, as you will read below, the predicted development of DeFi and NFTs.

Defi Liquidity Issues and Attracting Retail Usage in 2023

As volumes and liquidity in the crypto space decline, DeFi will continue to struggle with liquidity incentives and service development. Methods for obtaining this passive liquidity have been evolving since the beginning of DeFi, from liquidity mining rewards to newer concepts like protocol-owned liquidity. Still, the issue remains and needs to be addressed in the new year for DeFi to succeed as a scalable alternative to centralized financial services.

Token rewards have proven to be an unsustainable incentive for trading and market making, often leading to washing trading or “dumping” of platform assets. Most retail users do not have the time or ability to optimize execution and manage their positions. This complexity can be a big hurdle for retail investors to put their money into the DeFi space.

In 2023, there should be a movement towards more structured products. I spoke with IceCreamMan, one of the founding members of Project JONES on Layer 2 protocol Arbitrum. Discussing their structured products, he said: “For example, jUSDC is a delta-gamma neutral stablecoin library that provides loans to other Jones structured products in a safe and transparent way to obtain blue chip income, enforced by smart contracts. Execution.” While this highlights the inherent complexity of the DeFi market for retail users, it also shows that there are many attempts to simplify the process and make it easier for retail users to enter the space (and reap its benefits).

Regulatory Issues and Attracting Institutional Use

With regulation coming into focus at the end of 2022, and the uncertainty that comes with it, many institutions are hesitant to adopt decentralized distributed ledger technology. The concept of ” permissioned DeFi ” may offer a solution to help institutions overcome the pain of regulation.

In November 2022, we see JPMorgan Chase and DBS Bank ’s new proposal for foreign bond transactions on the Polygon blockchain, which also supports on-chain verifiable certificates. I believe this is an early example of a major bank using tokenized deposits on a public blockchain. In 2023, I expect to see more and more government-led (if not supported) initiatives, working with leaders from various industries to explore the adoption of DeFi.

While “Permissioned DeFi” is not inherently decentralized, how far institutions will go in pursuit of client interests and how much power, if any, they are willing to give up in their pursuit of decentralization and decentralized finance , remains to be seen. Most likely, there will be tension between users choosing a truly crypto-native platform (such as XGo ) to help connect and support customers’ DeFi experiences, and traditional financial institutions trying to leverage the benefits of DeFi to serve their customer base. tension.

NFT in 2023, the fusion of games, metaverse and NFT

As an industry, NFT avatar projects are already trending towards interoperable Metaverse integration. Evidence for this has increased significantly by 2022 and this trend is likely to continue until 2023.

Also, Otherdeed, Cooltopia and Spacedoodles are investing a lot of energy and money, but this is just the tip of the gamification iceberg. The question remains whether this will be a catalyst for mass adoption, and even if it is, it remains to be seen whether the upcoming metaverse will be truly decentralized.

The current trend towards stability and sustainability of Web3 games is in many ways caused by issues with Axie Infinity and its play-to-earn (P2E) model, which will spawn a wave of other products with built-in stability.

Additionally, the early 2023 ecosystem is in danger of overreacting and is designed to be insulated from the dynamic boom and bust nature of most crypto speculation. This runs the risk of creating a homogenous, bland player experience that feels like a knockoff of existing traditional video games.

Still, we haven’t seen anything close to a metaverse like Minecraft. The year ahead will show that tokenomics, gamification, and speculation are used in healthy, responsible ways. Furthermore, those platforms that use NFTs and cryptocurrencies to make games will achieve mass adoption, and these features are not all their pitches. Players should engage with these techniques without realizing it.

What’s more, as we move into 2023, a battle is gaining momentum. There are two emerging approaches to Web3 game development: crypto companies going into gaming, and gaming companies going into crypto. The latter is dominated by companies like Limit Break, a new company developing Web3 massively multiplayer online games from former Machine Zone CEO Gabriel Leydon.

“People think that Web3 gaming is the future,” Leydon said, before adding, “But it’s not. It needs people to design and build it right.” Limit Break intends to incorporate Web3 elements into the “free to play” model, This is a marked departure from the crypto-native-first approach of 2022. The reality is that typically less than 5% of mobile gamers will pay for anything, so for mass adoption these folks have to be included.

Hi, Neat post. There is an issue with your site in web explorer,

might test this? IE still is the marketplace chief and a huge part of folks will pass over your magnificent writing due to this problem.

This site definitely has all of the info I needed concerning this subject and didn’t know who

to ask.

Hello my loved one! I wish to say that this post is awesome, nice written and include approximately all important infos.

I’d like to see extra posts like this .