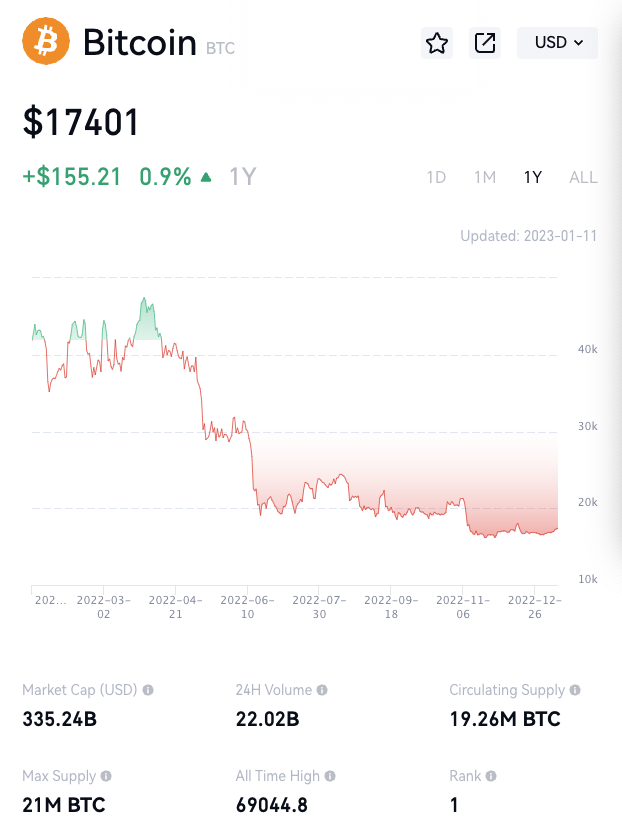

Since the beginning of November last year Bitcoin Since it effectively fell below 20,000 knives, it has been hovering in the low-altitude range of 15-20k.

The Federal Reserve continued to release hawk FUD, but Bitcoin was unmoved and still stood firmly at 16.8k.

A bear market is all bad, and a bull market is all good. You think you have the freedom to decide your own actions, but in fact your brain has been firmly controlled by the artificially created “information cocoon”.

2024 will be a very meaningful year in the history of Bitcoin development. Because in this year, Bitcoin will usher in the fourth halving of its output in its history, from 6.25 BTC per block to 3.125 BTC.

Historically, Bitcoin has experienced three halving events, which are: in 2012, from 50 BTC to 25 BTC; in 2016, from 25 BTC to 12.5 BTC; in 2020, from 12.5 BTC to 12.5 BTC Half to 6.25 BTC.

Historically, every production halving event will bring a production reduction shock. The impact of production cuts will directly reduce the number of bitcoins released to the market, resulting in a supply shortage and triggering price hikes.

Historically, the timing (block time) of each production reduction event has been predetermined by a computer program.

The upcoming 4th Bitcoin production cut event in 2024 is no exception. We can accurately predict that the block time of its occurrence is 840,000 (block height), which corresponds to a certain point in March 2024 in our earth time.

This is not actually a prediction, but a setting.

Regarding this setting, there is a detailed explanation in the “Bitcoin Yellow Paper”.

From this point of view, Bitcoin is a store of value asset with the most deterministic monetary policy.

Game theory tells us that the most certain way of issuing money is the best monetary policy.

The fully predetermined, open and transparent issuance of Bitcoin is the best monetary policy. It is 100 times, 10,000 times better than the black-box politics of the Federal Reserve where a few old men meet behind closed doors to formulate monetary policy.

Bitcoin’s 2024 halving event will be the first critical milestone in the history of Bitcoin development, and it will also be an important watershed. This bear-to-bull conversion will usher in the most meaningful leap and turning point in the history of Bitcoin development, that is, the reduction in production in 2024 will increase the S2F hardness of Bitcoin from the current 56 to about 120, surpassing Bitcoin in one fell swoop. Gold with a hardness of 62, it has become the most “hard” asset on our planet.

At the peak of the bull market bubble in 2021, the market value of Bitcoin once ranked among the top ten assets in the world, comparable to the market value of leading US stock companies. At the same time, Bitcoin also showed a strong correlation with the trend of US stocks. If the definition of the 2021 cycle is to challenge US stocks, then the 2024-2025 bull market cycle is to challenge the world’s number one asset class – gold.

Today, the total market capitalization of gold is about $12 trillion. At a price of $17k, Bitcoin has a market value of about $330 billion, which is 36 times the total market value of gold. The total number of bitcoins today is 19.22 million. It is estimated that about 660,000 pieces will be produced in 2023-2024. The total amount reached 19.88 million pieces. Based on the calculation of approximately 20 million pieces, the market value has reached 12 trillion U.S. dollars, and the unit price should be 600,000 U.S. dollars per bitcoin.

In the last round of bear market, the bottom was more than 3,000 at the end of 2018, and the top of the bull market was 69k at the end of 2021, an increase of about 23 times. According to the current 17k increase of 23 times, it is 390,000 or about 400,000 US dollars a bitcoin, multiplied by 20 million, and the total market value is 8 trillion US dollars, which is about 67% of the 12 trillion US dollar market value of gold.

Even with a smaller increase, such as 17 or 8 times, reaching 300,000 US dollars a bitcoin, the total market value is 6 trillion US dollars, which is about half of gold. even if not go beyond the market value of gold has reached a similar order of magnitude, and it can also be said to be comparable to gold.

We have reason to believe that Bitcoin will usher in an important leap in its development history in a year or two, and stride into the next historical stage!

Bitcoin, as a resource with no obvious substitute, has been recognized by large institutions and even small and medium-sized countries in the past cycle. The trend of the expansion of this consensus is irreversible, especially in today’s global environment where geopolitical risks are increasing and the risk of dollar asset dishonesty is increasing, it will only make more and more people, institutions and countries, especially A large number of financial entities that cannot be autonomous, or that may incur financial sanctions imposed by the United States and its allies, are increasingly aware of the importance of deploying Bitcoin to hedge against some extreme strategic risks.

As a reserve asset of this level, the ability to hedge geopolitical risks requires sufficient water storage capacity and buffer capacity. The only problem with Bitcoin taking on this glorious task today is that the price is still too low and the market value is too small. Pools and buffers are not big enough.

This is what we often say, the higher the price of Bitcoin, the more valuable it is.

If you complain too much, you will not be heartbroken, and you should look at the long-term scenery. Pulling our eyes away from the daily, weekly and even monthly lines, we will find that there has never been a bear market in Bitcoin?

“Standing on the scale of two long-wave cycles and overlooking the bull-bear transitions of each short-wave cycle, it is really like flying above the blue sky and white clouds, looking down at the waves in the long river of history. This is Bitcoin The grandeur and vastness of the magnificent history from scratch, to commercialization, to capitalization, and finally to monetization is beyond our limited imagination.”

On the scale of two Kondratieff cycles, we will be able to see Bitcoin use its meandering trend to draw a magnificent epic picture: Bitcoin’s century-old bull.