Bitcoin and other cryptocurrencies raised for a fourth day in a row, with the digital asset surging to its highest level since last summer despite widespread worries in financial markets in recent days.

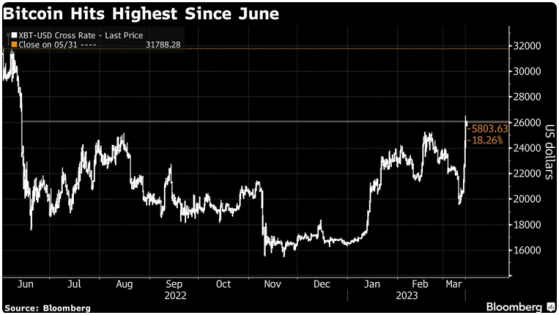

The price of Bitcoin has surged more than 9 percent in the past 24 hours to $26,533, its highest level since the crypto crash accelerated last June. Bitcoin raised to highs above $25,000 last month from around $16,500 in early January, but stalled in March and fell as low as $20,000 last week amid concerns over crypto banking and the regulatory landscape the following. This latest move suggests a renewed bullish start for Bitcoin.

Bitcoin has raised about 30% since the collapse of Silicon Valley Bank on March 10. About $230 million in short cryptocurrency positions were liquidated in the past 24 hours, according to derivatives trading data site Coinglass.

“A break above $25,200 would be long-term bullish,” said Katie Stockton, managing partner at technology research firm Fairlead Strategies.

There are complex, even contradictory dynamics in the cryptocurrency market.

In the past week alone, two of the most influential U.S. bankers on the crypto industry, Silvergate Capital and Signature Bank, have collapsed, which is not good for market liquidity and regulators’ sentiment towards digital assets.

At the time, traders were deeply concerned that SVB’s deposits could threaten the viability of a key stablecoin as the bank struggled in the banking industry.

However, Bitcoin managed to jump higher in the face of these headwinds.

Some traders point to one of the guiding principles of bitcoin’s birth — that it is a safe store of value in the face of mainstream financial crises. Alex Kuptsikevich, an analyst at brokerage FxPro, noted: “Bitcoin’s store of value function was reintroduced over the weekend.” But that doesn’t tell the whole story.

The surge in cryptocurrencies is more likely due to the correlation between digital assets and stocks — while the Dow Jones Industrial Average and S&P 500 fell sharply on Monday, but Bitcoin surged.