Hong Kong Securities & Futures Commission (SFC) launched a consultation on 20th March on the proposals for virtual asset trading platforms, and stated that according to the new licensing system that will come into effect on June 1, 2023, all centralized exchanges need to be issued by the SFC. It will be able to operate in Hong Kong only after obtaining the license, and the consultation will end at the end of March.

(Previous summary: Hong Kong issued a “virtual asset exchange” license in June; China Telecom will launch a blockchain SIM card in Hong Kong)

(Supplementary background: Hong Kong’s “Virtual Asset Trading License” was launched in June, and Victory and Interactive Brokers were the first to be listed)

Hong Kong plans to allow residents to freely buy and sell cryptocurrencies on June 1 this year. The licensing system for virtual asset services that was originally scheduled to be implemented on March 1 this year will be implemented in June. The final details and rules still need to wait for the official release.

Hong Kong SFC launches consultation

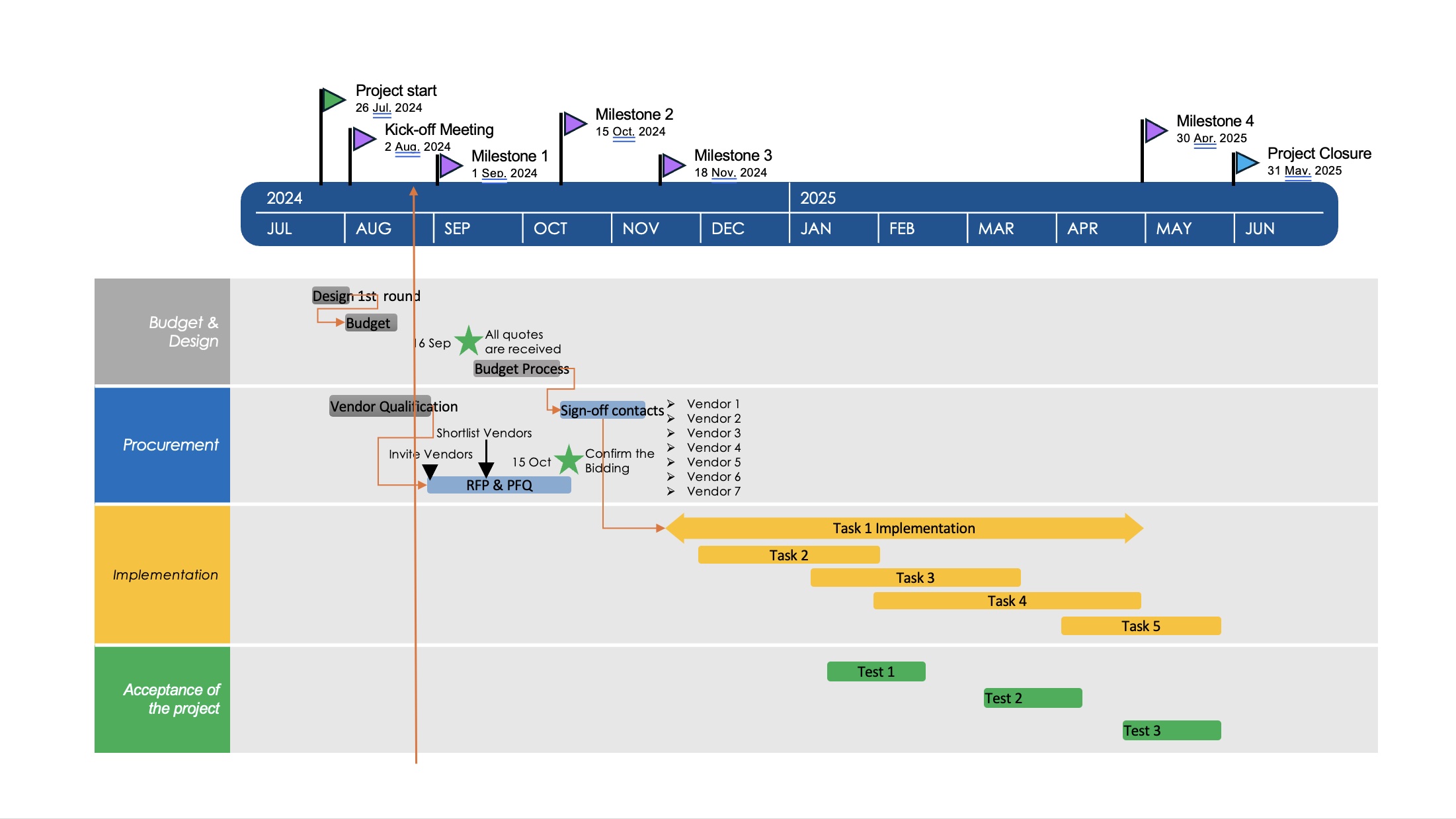

On 20th March, Hong Kong Securities & Futures Commission (SFC) launched a consultation on proposals for virtual asset trading platforms. The SFC stated that according to the new licensing system that will take effect on June 1, 2023, all centralized exchanges need Only after obtaining a license from the Securities & Futures Commission can it operate in Hong Kong, and the consultation will end on March 31. Ms. Leung Fung Yee, Chief Executive Officer of the SFC said:

In view of the recent turmoil in the global virtual asset market, coupled with the successive closures of some major cryptocurrency trading platforms, regulatory agencies around the world have reached a clear consensus that it is necessary to regulate the field of virtual assets to ensure that investors are fully protected and managed effectively major risk.

According to the announcement, a licensed exchange needs to meet the following basic conditions (currently a consultation proposal, an informal version):

- Regulations for establishing business relationships with customers, assessing user risks,

- setting upper limits Establish a standard and review system for listed currencies

- Have due diligence on listed currencies

- Eligible large-scale virtual assets (Bitcoin and Ethereum, two of the largest digital assets by market capitalization, may be listed on exchanges in Hong Kong, an SFC spokesperson said.)

The Securities & Futures Commission announced that operators of virtual asset trading platforms (including existing platforms) planning to apply for licenses should begin to review and modify relevant systems and monitoring measures to prepare for the new system. Operators who do not intend to apply for a license should start preparing for the orderly termination of their operations in Hong Kong.

In addition, the SFC intends to publish several lists on its website to list the regulatory status of each virtual asset trading platform to the public, and will continue to cooperate with the Investor and Financial Education Committee to strengthen investor education for the Hong Kong public.

“Hong Kong concept currency” skyrocketed

In fact, Hong Kong Legislative Council passed the “Anti-Money Laundering and Terrorist Financing (Amendment) Bill 2022” on the third reading on December 7 last year. Those who engage in virtual asset exchange business in the future must report to the Hong Kong Securities & Futures Commission. To apply for a license, the relevant person must meet the criteria for suitable persons and comply with the anti-money laundering and terrorist financing requirements under the Anti-Money Laundering Ordinance, including the requirements for customer due diligence and record-keeping, as well as other regulatory requirements for investor protection. For example, safe custody of client assets, financial stability and avoidance of conflicts of interest.

It is worth noting that the emergence of the Hong Kong license has also brought a surge of “Hong Kong concept coins” in the encryption market, including FIL, VET, NEO, LRC, CFX, and ACH, all of which have increased by more than 10%-50%. The public chain project Conflux announced last week that it will cooperate with China Telecom to launch the Hong Kong virtual blockchain BSIM card, and its token $CFX has soared by about 433.2% in the past 7 days.